One thing I really love about the government lately is their goal to be as transparent as possible. Certainly they still have a ways to go, but I think healthcare has done some significant things when it comes to transparency into the government health programs. A great example of this is the Health IT Dashboard which has all of the data for the various health IT programs.

I don’t want to steal Carl Bergman’s thunder, because he’s already posted some really interesting Hospital EHR market share data and his previous EHR market share data. Plus, he’s planning to dive into the meaningful use market share data next. I love the approach of multiple sources when it comes to evaluating EHR market share and so I look forward to his analysis of EHR incentive market share against the EHR adoption market share from Definitive Healthcare and SK&A.

Until then, I thought I’d give you a taste of the EHR vendor participation in the EHR incentive program. This data comes from the ONC dashboards listed above and are put into some really nice snapshots of the data by ONC.

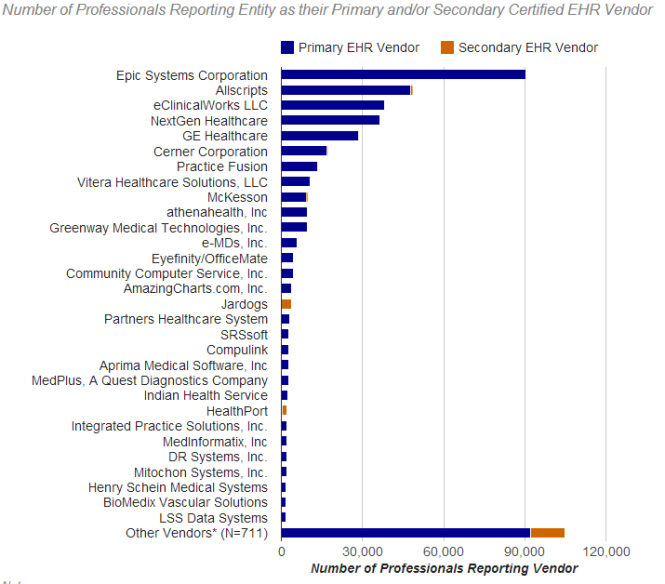

First up is the data for EHR vendor attestations by eligible professionals (ie. ambulatory doctors):

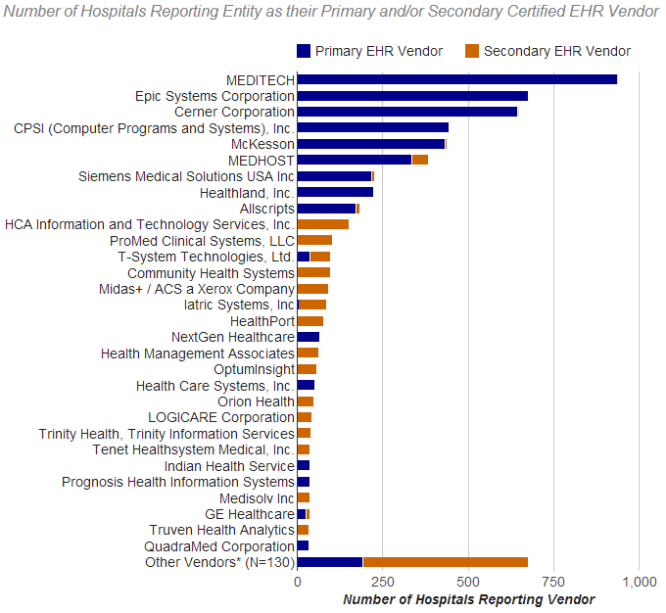

And the EHR vendor attestations by hospitals:

It’s worth noting that the above data is just the EHR incentive money data. No doubt the actual EHR adoption data would have a few differences and include some companies in specialties that don’t qualify for EHR incentive money. Not to mention specialty specific EHR vendors who likely don’t make the chart even if they dominate their specialty. These charts do serve as an interesting proxy for EHR market share that’s worthy of discussion even if it doesn’t paint the full picture. Plus, even more important will be to watch the change in these numbers over time.

With that disclaimer, we could analyze this data a lot of ways. I’ll just offer a few interesting insights I noticed. First, 711 vendors have been used in the ambulatory EHR incentive program. That’s a lot of vendors. Only 78 of those 711 supply secondary EHRs as opposed to the primary EHR. 452 EHR vendors supply a primary EHR to less than 100 eligible professionals. 200 EHR vendors supply a primary EHR to fewer than 10 eligible professionals. These observations and a comparison of the ambulatory versus hospital EHR incentive charts’ “Other Vendors” shows how fragmented the ambulatory EHR market share is right now.

I was also intrigued that Mitochon Systems, Inc. was on the list even though they shut down their Free EHR software in May 2013. They had white labeled their EHR software to a number of other companies and so it will be interesting to see how that number evolves. I assume they sold the software to those companies, but I hadn’t heard an update.

On the hospital side of things, MEDITECH certainly doesn’t get the credit they deserve for the size of their install base. The same goes for CPSI, MEDHOST and Healthland. I think their problem is that people only want to read about the Mayo, Cleveland Clinic, and Kaiser’s of the world and so the articles about Billings Montana Hospital (I made that hospital up) rarely happen. I should find more ways to solve that since the small hospital market is huge.

I do wish that there was a way to divide the ambulatory chart into hospital owned ambulatory practices and independent ambulatory practices. That would paint an even clearer picture of that market.

What do you think of these charts? What can we learn from them?

An article about EHRs in Billings, Montana, and surrounding areas.

http://www.npr.org/blogs/health/2014/04/24/305858575/rural-hospitals-weigh-independence-against-need-for-computer-help

Jon,

Interesting charts. I’d like to see # of lives covered by EHR vendor.

Matthew,

I’ve never seen that number really since it’s hard to calculate. Closest I’ve seen is Epic likes to say something like half of those in the US have a chart in Epic. Not quite a covered life, but certainly a lot of patients in Epic.

Thanks Eric. Go NPR. 28 comments on it as well. I appreciate you sharing.